The gig economy is reshaping the way we work and manage our finances. Freelancers and self-employed individuals face unique challenges when it comes to tracking income, managing expenses, and planning for taxes and retirement. QuickBooks for Freelancers offers a tailored solution to help navigate the financial complexities of the gig economy. This article delves into the essential strategies for effectively managing gig economy earnings using QuickBooks, ensuring financial growth and stability for freelancers.

Key Takeaways

- Understanding the gig economy is crucial for freelancers to adapt to its challenges, including irregular income and complex tax regulations.

- Setting up QuickBooks for Freelancers requires customization to fit individual business models and integration with other financial tools for comprehensive management.

- Accurate tracking of income and expenses in QuickBooks is essential for freelancers to understand their cash flow and make informed financial decisions.

- Freelancers must proactively manage taxes and compliance, using QuickBooks to estimate quarterly taxes and maximize business expense deductions.

- Planning for long-term financial stability involves setting clear financial goals, analyzing profit margins, and preparing for retirement, all facilitated by QuickBooks.

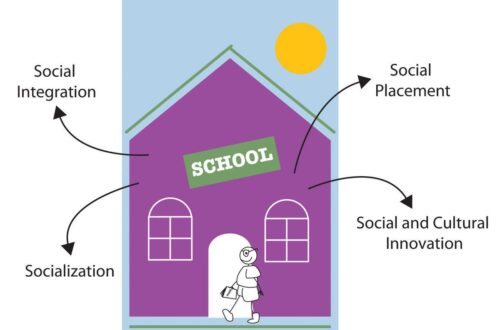

Understanding the Gig Economy Landscape

The Rise of Freelance Work

As I navigate the gig economy, I’ve come to understand that the allure of freelance work is undeniable. The freedom to choose projects, the flexibility of working hours, and the potential for diverse income streams are compelling reasons for the shift away from traditional 9-5 jobs. However, this independence comes with its own set of challenges.

In my experience, one of the most significant hurdles is the unpredictability of income. Unlike a regular salary, my earnings can fluctuate dramatically from month to month, making financial planning a complex task. Here’s a snapshot of my financial landscape as a freelancer:

- Monthly income variability

- Necessity for strict budgeting

- Importance of an emergency fund

The reality is that while the gig economy offers freedom, it demands a high level of financial discipline and acumen. Without it, even the most skilled professionals can find themselves struggling to make ends meet.

The story of Callie and Travis, a self-employed couple, illustrates the stark reality many face. Despite earning a combined gross revenue that seems substantial, their actual take-home pay after business expenses is akin to minimum wage. It’s a sobering reminder that gross income doesn’t always translate to financial security.

Challenges Faced by Self-Employed Individuals

As a self-employed individual, I’ve come to realize that the freedom of managing my own time comes with its own set of challenges. Navigating complex taxes, dealing with uncertain cash flows, and operating on tight profit margins are just the tip of the iceberg. For instance, I’ve heard stories of freelancers like Callie and Travis, who, despite their hard work, find themselves making barely more than minimum wage after accounting for business expenses.

The gig economy isn’t just about flexibility and independence; it’s also about facing the harsh realities of financial management and stability.

Moreover, the current economic climate has not been kind to small businesses, with a significant increase in bankruptcy filings indicating a broader issue. It’s clear that without proper financial planning and management, the risks can be substantial. Many of us, including Travis from the survey, try to handle bookkeeping on our own, which can lead to further complications without the right tools and expertise.

The Importance of Effective Financial Management

As a freelancer in the gig economy, I’ve come to realize that effective financial management is the cornerstone of a sustainable business. Without it, even the most talented professionals can find themselves struggling to maintain a steady income and grow their business.

One of the top ways to manage finances is to create a budget. This allows me to have a clear understanding of my income and expenses, ensuring that I’m not spending more than I’m earning. Additionally, establishing an emergency fund is crucial for those unexpected expenses that can otherwise derail my financial stability.

Diversifying income streams is another key strategy I’ve adopted. It helps mitigate the risk of income fluctuation, which is a common challenge in the gig economy. Mastering tax planning is also essential, as it can significantly affect my net income.

Here’s a simple list of financial management practices I follow:

- Create a budget

- Establish an emergency fund

- Diversify income streams

- Master tax planning

By adhering to these practices, I’m not only protecting my current financial status but also laying the groundwork for future growth and stability.

Setting Up QuickBooks for Freelancers

Creating a QuickBooks Account

Starting my journey with QuickBooks for Freelancers was simpler than I anticipated. The first step was to create an account, which is the gateway to managing my gig economy earnings more effectively. Creating an account is crucial as it sets the foundation for all the financial tracking and management that follows.

Here’s a quick rundown of the steps I took to get started:

- Visited the QuickBooks website and selected the Freelancers version.

- Clicked on the ‘Sign Up’ button to begin the registration process.

- Entered my personal and business information as prompted.

- Chose a subscription plan that suited my business needs.

- Set up a secure password and added two-factor authentication for extra security.

Once my account was active, I felt a sense of relief knowing that I had taken the first step towards financial organization. The process was intuitive, and QuickBooks provided helpful tips along the way to ensure I didn’t miss any critical details.

Customizing QuickBooks for Your Business Model

After setting up my QuickBooks account, I realized the importance of tailoring the platform to fit my unique business needs. Customizing QuickBooks is essential for streamlining my financial processes and ensuring that the data reflects my specific operations.

For instance, I took advantage of QuickBooks’ feature to customize invoices, estimates, and sales receipts. This allowed me to present a professional image to my clients and maintain consistency across all my documentation. Here’s a brief rundown of the steps I followed:

- Go to Settings

- Select Custom form styles

- Choose New style

By personalizing these elements, I’ve been able to reinforce my brand and make my business stand out.

Moreover, I’ve set up specific categories for income and expenses that align with the services I offer. This categorization is crucial for accurate reporting and tax preparation. It’s a game-changer for managing my gig economy earnings effectively.

Integrating with Other Financial Tools

Once you’ve tailored QuickBooks to your freelance business, the next step is to integrate it with other financial tools you use. This can streamline your workflow and ensure all your financial data is in sync. For instance, integrating QuickBooks with your bank and credit card accounts allows for real-time transaction updates, which is crucial for maintaining accurate financial records.

Integrating project management tools can also significantly enhance your productivity. Here’s a list of project management tools that offer QuickBooks integration:

- Rodeo Drive

- Scoro

- Avaza

- Monday

- Streamtime

- Function Point

- [Title: 7 Project Management Tools With QuickBooks Integration](#)

By connecting these tools, you can track project expenses, invoice clients, and manage your time more efficiently, all within a unified system. This not only saves time but also reduces the likelihood of errors that can occur when manually transferring data between different platforms.

Tracking Income and Expenses

Recording Gig Earnings Accurately

As a freelancer, I’ve learned that keeping a precise record of my earnings is crucial for financial clarity and stability. QuickBooks for Freelancers simplifies this process, allowing me to track every payment received for my gigs. Here’s a straightforward approach to ensure your gig earnings are recorded accurately:

- Step 1: Create a new income entry for each gig completed.

- Step 2: Attach any related invoices or payment confirmations.

- Step 3: Categorize the income based on the type of service provided.

- Step 4: Review the entries regularly to ensure completeness and accuracy.

By consistently updating my QuickBooks with the latest income data, I can immediately see the health of my business finances at any given time. This proactive habit also prepares me for tax season, making it less of a headache.

It’s important to remember that the gig economy can be unpredictable. One month might be lucrative, while the next could be lean. By maintaining a detailed record in QuickBooks, I can analyze trends and make informed decisions about my business. For example, I can compare my earnings to those of Travis, who, despite owning a successful business, faces challenges due to a lack of proper bookkeeping.

Categorizing Business Expenses

As a freelancer, I’ve learned that keeping my business expenses organized is crucial for financial clarity and tax preparation. Categorizing expenses allows me to see where my money is going and identify potential tax deductions. Here’s a simple approach I use:

- Identify the nature of each expense.

- Allocate expenses to the appropriate categories.

- Review regularly to ensure accuracy.

For instance, I categorize my expenses into groups such as ‘Marketing’, ‘Supplies’, and ‘Travel’. This not only simplifies tax filing but also provides valuable insights into my spending patterns.

It’s essential to remember that personal funds used for business expenses should be recorded properly to avoid confusion. The process might include selecting the appropriate bank account for reimbursement and categorizing the expense accordingly.

By staying diligent with these practices, I can maintain a clear financial picture and make informed decisions for my business.

Understanding Cash Flow

As a freelancer, I’ve learned that cash flow is the lifeblood of my business. Managing cash flow effectively is crucial for sustaining operations and ensuring financial health. It’s not just about how much I earn, but when the money actually lands in my bank account. To keep a clear picture, I regularly update a simple table that reflects my monthly cash flow:

| Month | Income | Expenses | Net Cash Flow |

|---|---|---|---|

| Jan | $5,000 | $3,000 | $2,000 |

| Feb | $4,500 | $2,800 | $1,700 |

| Mar | $6,000 | $3,500 | $2,500 |

This table helps me spot trends and plan ahead, ensuring I’m never caught off guard by an unexpected bill or a slow-paying client.

Maintaining a buffer of savings to cover at least two months of expenses has been a game-changer for me. It provides peace of mind and allows me to focus on growing my business rather than worrying about making ends meet each month.

Understanding my cash flow also means recognizing the timing of income and expenses. I’ve learned to anticipate seasonal fluctuations and to prepare for them by adjusting my spending or ramping up my marketing efforts accordingly. It’s a continuous balancing act, but one that’s essential for my long-term success.

Managing Taxes and Compliance

Estimating Quarterly Taxes

As a freelancer, estimating quarterly taxes is a crucial part of financial management. To use the estimate method, you look at what you paid last year and divide by four. That’s your baseline for quarterly installment payments. For instance, if I paid $10,000 in taxes last year, my estimated quarterly tax payment would be $2,500.

It’s essential to adjust these estimates if your income fluctuates. If I anticipate earning more this year, I’ll increase my quarterly payments to avoid underpayment penalties.

Here’s a simple breakdown of when estimated tax payments are typically due:

- Q1 payment: April 15

- Q2 payment: June 15

- Q3 payment: September 15

- Q4 payment: January 15 (of the following year)

Remember, these dates can vary if they fall on weekends or holidays, so it’s important to check the IRS calendar. Keeping track of these dates ensures that I stay on top of my tax obligations and avoid any unnecessary fines.

Deducting Business Expenses

As a freelancer, I’ve learned that maximizing tax deductions is crucial for financial success. QuickBooks has been instrumental in helping me identify and claim the deductions I’m entitled to. For instance, I’ve been able to explore 12 tax deductions for freelancers, ensuring that I don’t miss out on any opportunities to reduce my taxable income.

Here’s a quick rundown of common deductible expenses:

- Home office expenses

- Internet and phone bills

- Travel and mileage

- Equipment and supplies

- Education and training

Each category has its own set of rules for qualification, and QuickBooks makes it easier to keep track of these expenses throughout the year. It’s important to remember that proper documentation is key when it comes to claiming these deductions.

By diligently categorizing each expense and keeping detailed records, I’ve been able to streamline the process of deducting business expenses during tax time. This proactive approach has not only saved me money but also a significant amount of time and stress.

Staying Compliant with IRS Regulations

Ensuring compliance with IRS regulations is a critical aspect of managing my freelance finances. I meticulously review and finalize all necessary tax forms, such as the 1099s, within QuickBooks Online. This involves a thorough assessment of my financial records, aligning with the guidance provided by tax professionals.

It’s paramount to stay informed about the latest tax laws and filing requirements to avoid any potential legal issues or penalties.

Here’s a checklist I follow to maintain compliance:

- Regularly update my knowledge of IRS regulations

- Accurately track and report all income and expenses

- Prepare and file taxes on time

- Consult with a tax advisor for complex situations

The current economic climate presents additional challenges for small businesses, with rising interest rates and cash flow issues. However, by staying proactive and informed, I can navigate these obstacles and ensure my business remains on solid legal ground.

Planning for Financial Growth and Stability

Setting Financial Goals

As I navigate the gig economy, I’ve learned that setting financial goals is crucial for my financial growth and stability. It’s not just about earning more; it’s about creating a roadmap for where I want my finances to be in the future. To start, I outline my short-term and long-term objectives, which helps me stay focused and motivated.

By managing my personal finances, taxes, and savings effectively, I can mitigate the uncertainty that often accompanies freelance work. Establishing good practices is essential for organizing my finances and gaining a clear understanding of my tax obligations.

Here’s a simple framework I use to set my financial goals:

- Identify my income targets: How much do I need to earn to cover my expenses and save for the future?

- Determine my savings goals: What percentage of my income should I allocate to savings and investments?

- Plan for retirement: How much do I need to contribute to my retirement accounts annually?

- Set aside funds for taxes: Estimating my tax liability helps me avoid surprises during tax season.

By adhering to this framework, I’m not only preparing for the immediate future but also laying the groundwork for long-term financial security.

Analyzing Profit Margins

As I delve into the financial health of my freelance business, I’ve learned that analyzing profit margins is crucial for sustainable growth. It’s not just about how much I earn, but how much of that translates into actual profit after covering all expenses. To get a clear picture, I calculate several key ratios using numbers from my income statement.

For instance, I start with the Gross Profit Margin, which is Gross Profit divided by Net Sales. This tells me how much money I’m making after accounting for the cost of services provided. Then, I look at the Net Profit Margin, which is Net Income divided by Net Sales, to understand what percentage of my revenue remains after all expenses.

Here’s a simple breakdown of the calculations I perform:

| Ratio | Calculation |

|---|---|

| Gross Profit Margin | Gross Profit / Net Sales |

| Net Profit Margin | Net Income / Net Sales |

| Operating Profit Margin | Operating Income / Net Sales |

| Pretax Profit Margin | Pretax Income / Net Sales |

By regularly monitoring these margins, I can make informed decisions about pricing, cost management, and investment strategies. It’s a proactive approach to ensure my business isn’t just surviving, but thriving.

Preparing for Retirement and Savings

As I reflect on the financial landscape of my freelance career, I’m acutely aware of the importance of preparing for retirement and savings. The stark reality is that many freelancers, like myself, may not be giving enough attention to our long-term financial health. It’s crucial to start planning early, and QuickBooks for Freelancers can be an instrumental tool in this process.

By setting aside a portion of each gig’s earnings into a retirement account, I’m building a safety net for the future. It’s not just about saving; it’s about investing in my later years.

Here’s a simple breakdown of how I allocate my monthly income:

| Category | Percentage of Income |

|---|---|

| Operating Expenses | 50% |

| Tax Savings | 20% |

| Retirement Savings | 15% |

| Emergency Fund | 10% |

| Personal Use | 5% |

This table serves as a guide to ensure that I’m not only meeting my current needs but also securing my financial future. Adjustments are made as necessary, especially as my freelance work fluctuates. Remember, the goal is to create a balanced approach to managing earnings, one that includes a clear path to a comfortable retirement.

Conclusion

Navigating the financial complexities of the gig economy can be daunting, but tools like QuickBooks for Freelancers offer a lifeline for those looking to manage their earnings effectively. As we’ve seen with Travis and Callie’s story, lack of proper bookkeeping and financial transparency can lead to significant stress and uncertainty. By leveraging the features and insights provided by QuickBooks, freelancers can gain a clearer picture of their financial health, make informed decisions, and potentially avoid the pitfalls of underestimating expenses and overestimating profits. Whether you’re a seasoned entrepreneur or just starting out, embracing such tools can be a game-changer in achieving financial stability and success in the gig economy.

Frequently Asked Questions

What is the gig economy and how has it changed the landscape of freelance work?

The gig economy refers to a labor market characterized by the prevalence of short-term contracts or freelance work as opposed to permanent jobs. It has grown significantly with the rise of digital platforms that connect freelancers with opportunities. This shift offers flexibility and autonomy but also presents challenges such as income unpredictability and the need for self-managed financial and tax obligations.

Why is it important for freelancers to use a tool like QuickBooks?

Using a tool like QuickBooks helps freelancers manage their finances by tracking income and expenses, categorizing transactions for tax purposes, and providing insights into their business’s financial health. It simplifies accounting tasks, which is crucial for individuals who may not have formal training in finance or accounting.

How can QuickBooks help freelancers estimate and manage their taxes?

QuickBooks for freelancers offers features that allow users to track their earnings, categorize expenses for deductions, and estimate quarterly taxes. It helps ensure compliance with IRS regulations and can prevent underpayment penalties by providing timely and accurate tax estimates.

Can QuickBooks integrate with other financial tools and platforms used by freelancers?

Yes, QuickBooks can integrate with various financial tools and platforms, such as payment processors, bank accounts, and other business applications. This integration streamlines financial management by automatically importing transactions and reducing manual data entry.

What are some strategies for financial growth and stability in the gig economy?

Strategies for financial growth and stability include setting clear financial goals, regularly analyzing profit margins to adjust pricing or cut costs, and diversifying income streams. Additionally, freelancers should prioritize saving for retirement and building an emergency fund to cushion against income fluctuations.

How can freelancers ensure they are making a sustainable income in the gig economy?

Freelancers can ensure a sustainable income by accurately tracking and managing their business finances, setting competitive rates that reflect their skills and experience, and regularly reviewing their business model to adapt to market changes. Networking and marketing are also key to maintaining a steady flow of gigs.